PRT Monitors

Stay up to date with the latest PRT Market insights

Pension Risk Transfer Market Reports

Each year, the Pension Risk Transfer market continues to grow, new records are set, and more plan sponsors turn to pension de-risking strategies. Banner Life Insurance Company and William Penn Life Insurance Company of New York are here to act as your guide, whether you’re taking a first look into PRT or staying abreast of market trends and performance to create a strategy for your business. Our comprehensive reports offer insight into transaction volume and the total market premium, to help you navigate the Pension Risk Transfer market and make informed decisions.

Pension Risk Transfer Monitor – Q3 2025

Market Update

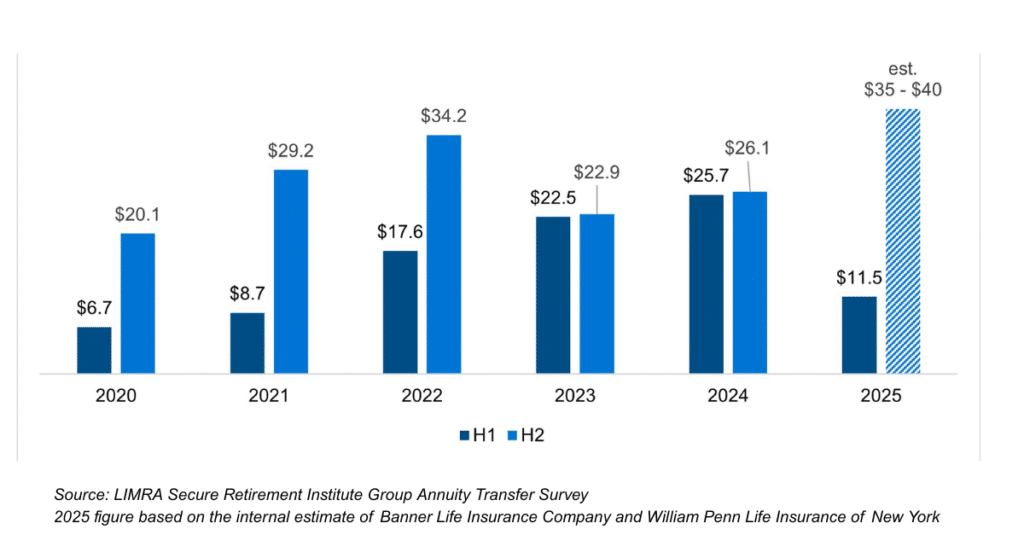

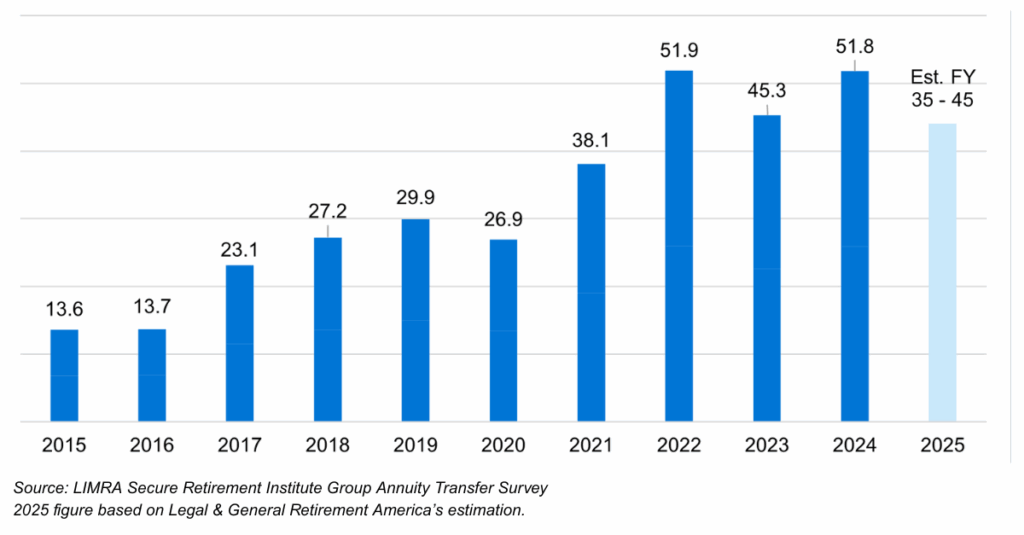

The US Pension Risk Transfer market reached $11.5 billion1 in total premium during the first half of 2025. The market demonstrated steady activity despite the absence of transactions over $1 billion, but the return of such transactions in Q3 has helped lift numbers for the year. In Q3 we’ve seen two transactions above $1 billion, bringing the total to three jumbo transactions in the first three quarters. We are estimating the third quarter to close around $9 billion, a decrease compared to Q3 2024’s $15.5 billion2, but a significant increase over the prior quarter.

The average pension funding ratio remains above 100% and was reported at 105.5%3 in October according to L&G Asset Management America’s pension solution monitor, leaving plan sponsors in a favorable position to transact.

Total premium H1 2025

Est. size of Q3 2025 premium

Est. size of full year 2025

PRT Market Outlook

The first three quarters of the year may have been slower than last, but the fourth quarter is coming in strong with a significant rebound in anticipated volume. We estimate the year to finish between $45–$50 billion with Q4 projected to be among the largest quarters to date at an estimated $29 billion, setting the stage for the second half of 2025 to be one the largest on record (see graph to the right). We anticipate three more jumbo transactions to close in the fourth quarter, for a combined six jumbo transaction this year.

One trend to keep an eye on is the rise in buy-in transactions for plan terminations. We expect more than double the number of buy-in transactions to close this year compared to years prior. The reason behind the rise in buy-in transactions relates to plan sponsors looking to lock in pricing early in their de-risking journey.

Sources:

1. https://www.limra.com/en/newsroom/news-releases/2025/limra-economic-volatility-undermines-second-quarter-u.s.-pension-risk-transfer-sales/#:~:text=22%2C%202025%20%E2%80%94Total%20U.S.%20pension,billion%20in%20the%20second%20quarter.

2. https://www.limra.com/siteassets/newsroom/fact-tank/sales-data/2025/2q/u.s.-group-annuity-risk-transfer-activity–buy-out-sales-2025-second-quarter.pdf

https://www.limra.com/siteassets/newsroom/fact-tank/sales-data/2025/2q/u.s.-group-annuity-risk-transfer-activity–buy-in-sales-2025-second-quarter.pdf

3. Pension Solutions Monitor | L&G

Banner Life Insurance Company and William Penn Life Insurance Company of New York are active participants in the US Pension Risk Transfer market, and receive and analyze in the normal course of its business certain information provided to it and other market participants. All non-aggregated statistics presented herein are available in the public domain. The inputs for US aggregated statistics are widely available in the market but may be subject to individual confidentiality obligations. Although believed to be reliable, information obtained from third party sources has not been independently verified and its accuracy or completeness cannot be guaranteed.

The Banner Life family of companies’ life insurance and retirement products are underwritten and issued by Banner Life Insurance Company, Urbana, MD and William Penn Life Insurance Company of New York, Valley Stream, NY. Banner Life Insurance Company products are distributed in 49 states and in D.C. and Puerto Rico. William Penn Life Insurance Company of New York products are available exclusively in New York; Banner Life Insurance Company is not an authorized New York insurer and does not do business in New York. Each company is solely responsible for its own financial and contractual obligations. Product guarantees are backed by the financial strength and claims paying ability of the issuing company. CN01262026-4

Speak with a Pension Risk Transfer Expert Today

Have questions on Pension Risk Transfer? Our team can help you address your derisking needs with our custom solutions. Contact us today to learn more.

Previous PRT Market Reports

Read our previous Pension Risk Transfer news and see for yourself how the market has developed over the last several years. Download and review our previous PRT Monitors below.